Ira Income Limits 2025 For Backdoor

Ira Income Limits 2025 For Backdoor. If you are 50 and older, you can contribute an additional $1,000 for a total of. Roth ira income and contribution limits.

A backdoor roth strategy is a way to bypass the income limits and contribute to a roth ira indirectly. If your modified adjusted gross income (magi) is above certain income limits, then the amount you can contribute to a roth ira is phased out.

A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira.

For 2025, if your magi is $153,000 ($161,000 in 2025) or higher and you’re single, or $228,000 ($240,000 in 2025) or higher and you’re married filing.

What Is The Limit For Ira Contributions In 2025 Ilysa Leanora, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. For 2025, if your magi is $153,000 ($161,000 in 2025) or higher and you’re single, or $228,000 ($240,000 in 2025) or higher and you’re married filing.

Backdoor Ira Contribution Limits 2025 Judie Marcela, For single filers, the limit was between $138,000 and $153,000. For example, for 2025, although people might still be making at this point their 2025, but just to give a frame of reference, the ‘24 amount for married joint, like i said, it’s very high, for.

Backdoor Roth Contribution Limits 2025 Lois Sianna, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. In 2025, the income limit for a backdoor roth ira was between $218,000 and $228,000 for joint filers.

Backdoor Roth Ira Contribution Limits 2025 2025 Terra Rochelle, Backdoor roth ira contribution limits 2025 over 50. In 2025, you cannot contribute directly to a roth ira if you’re single with a modified adjusted gross income (magi) over $161,000 or married with a joint magi over.

Backdoor Roth Ira Limits 2025 Jenn Karlotta, For 2025, if your magi is $153,000 ($161,000 in 2025) or higher and you’re single, or $228,000 ($240,000 in 2025) or higher and you’re married filing. If you are 50 and older, you can contribute an additional $1,000 for a total of.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, If your modified adjusted gross income (magi) is above certain income limits, then the amount you can contribute to a roth ira is phased out. Your personal roth ira contribution limit, or eligibility to contribute at all, is.

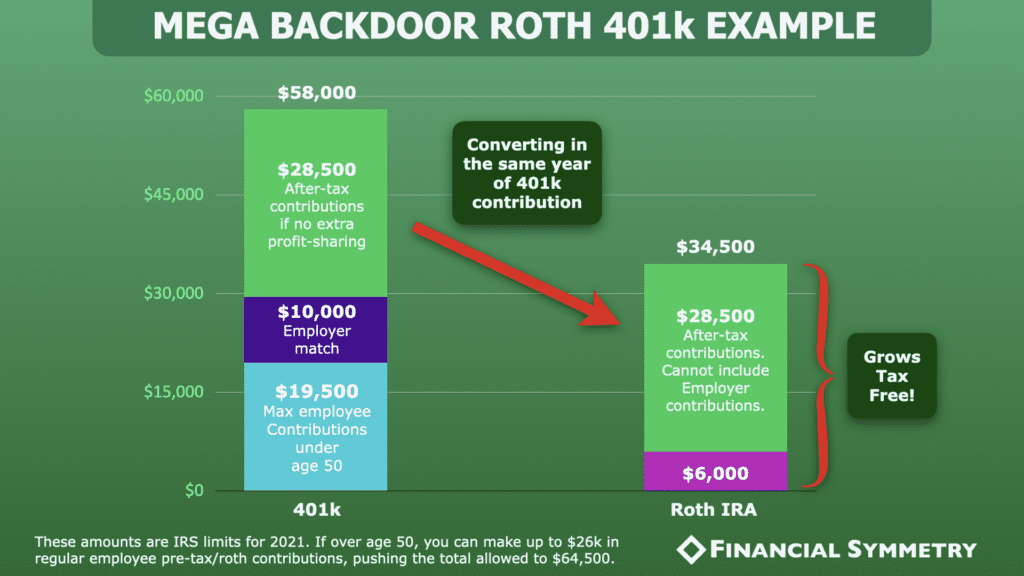

IRA Contribution Limits 2025 Finance Strategists, A backdoor roth strategy is a way to bypass the income limits and contribute to a roth ira indirectly. In 2025, the contribution limit is $23,000.

Backdoor Roth Limits 2025 Flora Jewelle, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. If your modified adjusted gross income (magi)*** for the calendar year ending december 31st 2025 is going to be above the 2025 irs upper income limits which are $161k for a.

2025 Limits For Traditional Ira Clair Demeter, A backdoor roth strategy is a way to bypass the income limits and contribute to a roth ira indirectly. A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira.

Backdoor Roth IRA Conversion and Strategy in 2025, Backdoor roth ira income limits 2025. In 2025, the contribution limit is $23,000.

Backdoor roth ira contribution limits 2025 2025 terra rochelle, if you have an annual income on the higher end of your category, your contribution limit may be reduced.